Monetize Your Energy Projects Faster

From investor-ready modeling to securing capital market access, we ensure your project is fundable, financeable, and fully executable.

(Data).png)

From investor-ready modeling to securing capital market access, we ensure your project is fundable, financeable, and fully executable.

(Data).png)

Secured Carbon is a financing engine. We're built for energy developers, helping you unlock liquidity, integrate tax credit transfers, PPAs, and federal/state incentive stacking into one cohesive capital strategy ensuring your project is fundable, de-risked, and built to close.

Embed financial intelligence into every stage, ensuring alignment between what’s modeled and what’s built.

Gain instant access to a pre-vetted network of institutional tax equity buyers and financial backers seeking high-quality credit portfolios.

Accelerate your project timelines by 30%, locking in capital stack Commitments, improving cash flow predictability and reducing construction-stage financing risks.

With pre-approved funding pathways, your projects become more attractive to lenders, EPCs, and offtakers, allowing you to build, finance, and scale with confidence and velocity.

Just drop in your project details. Our models calculate every eligible credit and adder automatically.

Our compliance engine verifies everything in real time, so you’re always aligned with the latest IRS rules and capturing up to 40%+ in credit value.

Pre-verified buyers, auto-generated IRS documentation, and a ready-to-sell dashboard. Your credits move faster than ever.

Funds hit your account in days, not months. You keep more with our 1% flat fee (vs. 5–15% broker fees).

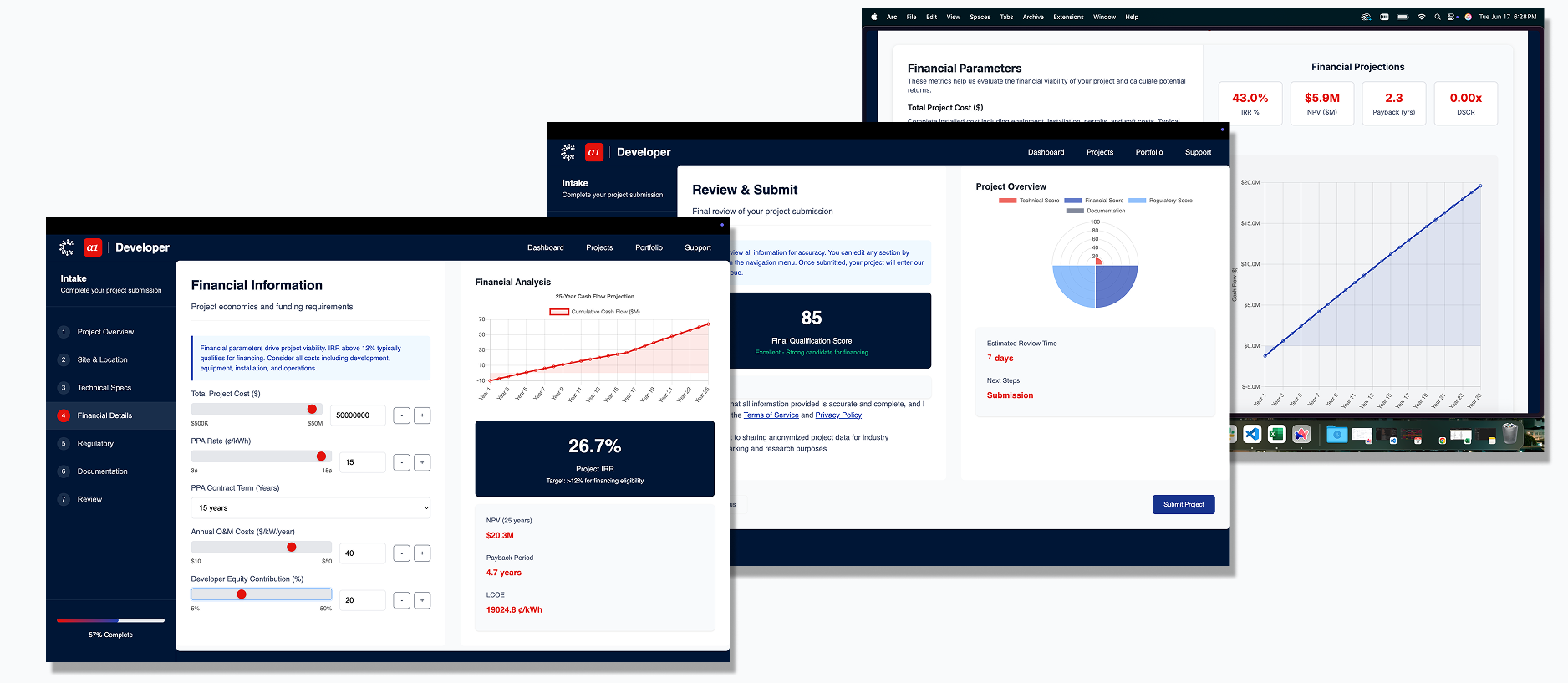

Submit your project and instantly receive risk and bankability scoring. We package your assets for funding eligibility.

We match you with aligned capital and automate tax-credit compliance to streamline investor engagement.

Bundle qualified projects into green bonds or portfolios ready for institutional investors—a process designed to scale.

At Secured Carbon, we're unlocking capital investment access for energy. Our platform democratizes renewable energy finance—empowering developers and investors through data, automation, and trust.

Capture 40%+ credit value in 3 days

Increase your value to clients, through tangible cost savings

Unlock institutional capital, streamline funding, and accelerate your path to deployment.

| Capability | Traditional Project Finance | Secured Carbon Financing |

|---|---|---|

| Capital Deployment Speed | 3–6 Months | 2–3 Weeks via Qualified Funding Tracks |

| Financing Options | One-Off Bank Loans or Equity | Multi-Channel Access—Tax Equity, Green Bonds, Debt Funds |

| Investor Readiness | Manual Docs + Negotiation | Standardized Bankability Metrics Pre-Vetted for Underwriting |

| Tax Credit Optimization | Basic 30% ITC Capture | Stacked Adders (Energy Communities, Domestic Content) |

| Deal Structuring | Brokered, High Friction | Platform-Native Structuring With Pre-Matched Buyers |

| Documentation & Compliance | Consultant-Driven, Time-Intensive | Digitized Intake + Audit-Ready Packages |

| Team Resources Required | Extensive Internal Lift | Minimal—We Handle Submission, Matching & Prep |

Our team combines decades of expertise in tax credits, finance, and technology

Expert in Fintech, Data & AI Platforms | State Farm, Standard Chartered Bank

$30B+ in Structured Bonds & Finance | Citibank, Bank of America, Stanford

Expert in Tax Law, Compliance & Tax Strategies

Risk, Compliance, Blockchain & AI

Stop leaving money on the table. Automate financing at scale.

Book Your Demo →