Secure More Tax Credit Value In Minutes

Register solar projects, save 200 hours, and capture 40% more tax credit value through transfer-all in one unified platform.

Register solar projects, save 200 hours, and capture 40% more tax credit value through transfer-all in one unified platform.

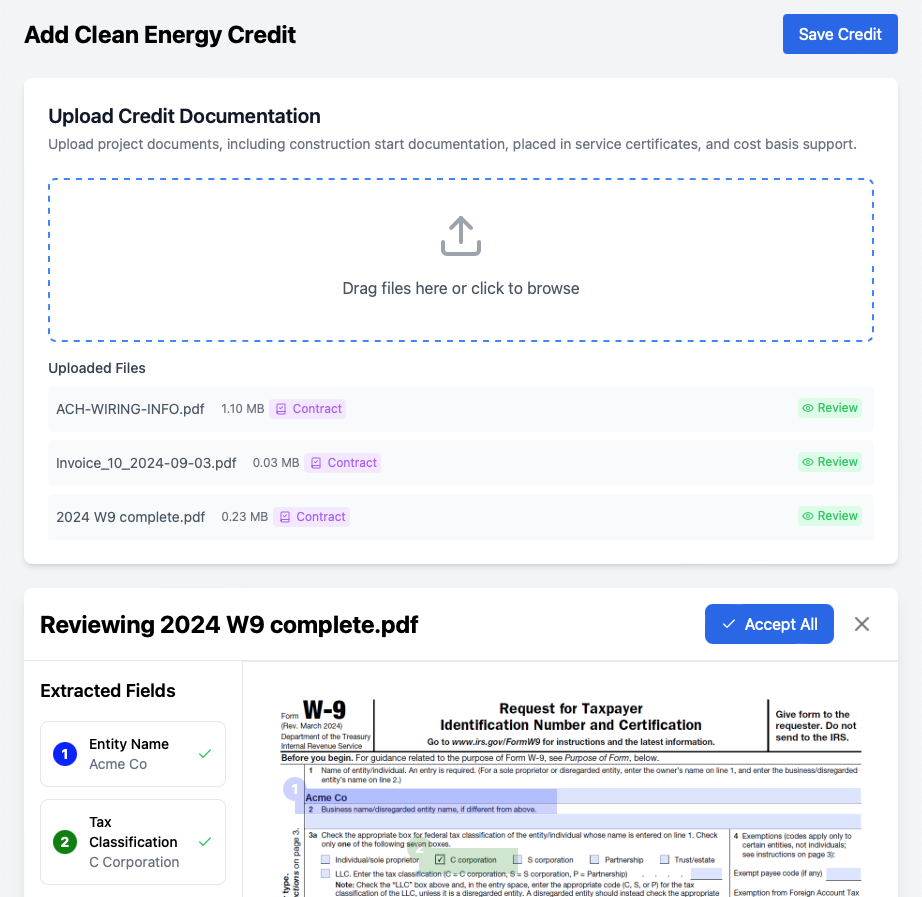

Just drop in your project details. Our AI calculates every eligible credit and adder automatically—no spreadsheets, no back and forth.

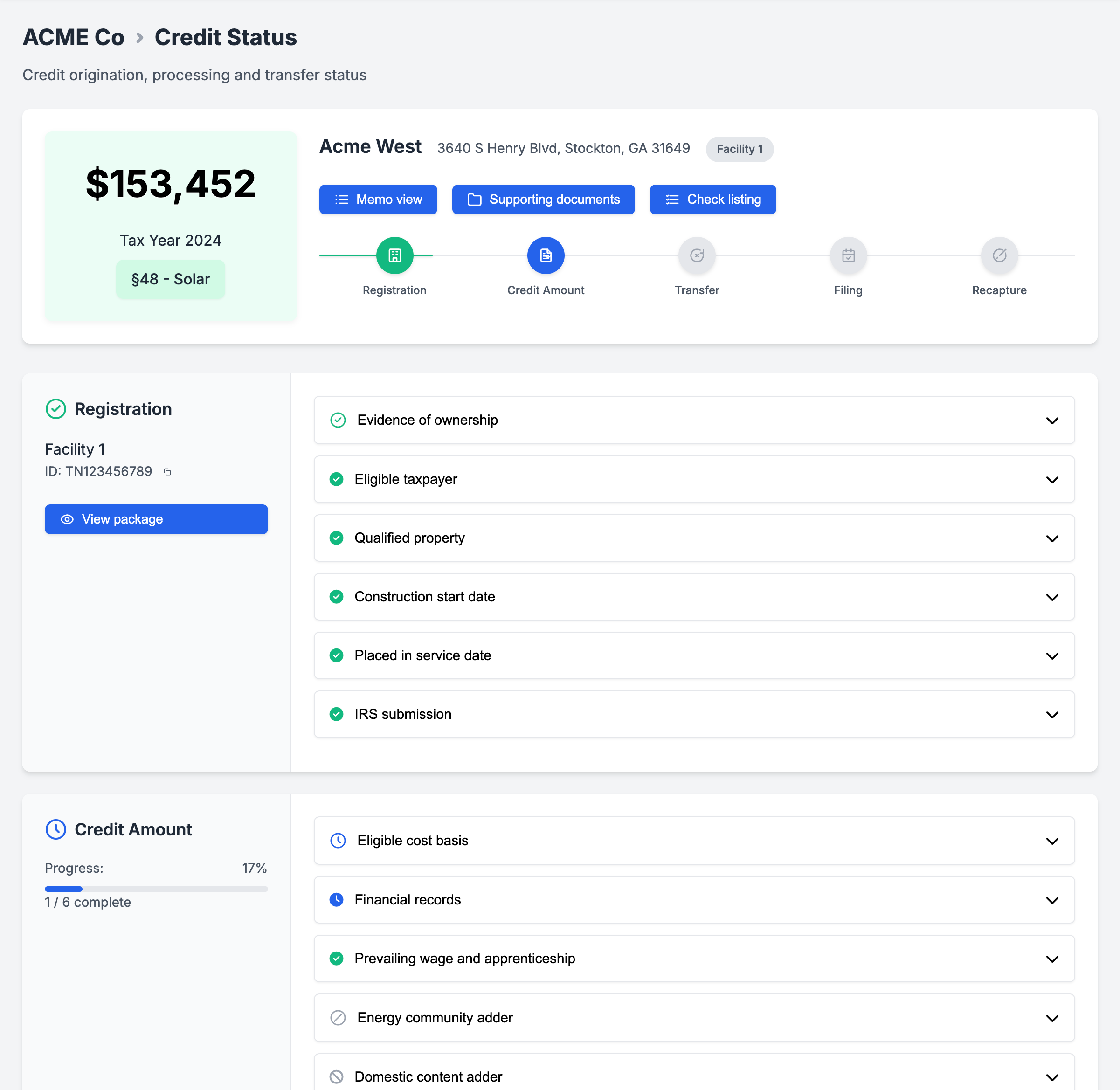

Our compliance engine verifies everything in real time—so you’re always aligned with the latest IRS rules and capturing up to 40%+ in credit value.

Pre-verified buyers, auto-generated IRS documentation, and a ready-to-sell dashboard—your credits move faster than ever.

Funds hit your account in days—not months. You keep more with our 1% flat fee (vs. 5–15% broker fees).

Capture 40%+ credit value in 3 days

Increase you value to clients, through tangible cost savings

Everything handled for you—start to finish

Track progress with full visibility

You move faster and smarter, capturing more value.

| Feature | Traditional Process | Secured Carbon |

|---|---|---|

| Time to Register & Transfer | 30–45 Days | 3–5 Days |

| Credit Value Captured | Base 30% Only | Up to 40%+ with IRA Bonus Adders |

| IRS Compliance | Manual Review, Risk of Rejection | Automated + Expert Validated, 100% IRS-Ready |

| Documentation Process | Spreadsheets, Consultants, Delays | End-to-End Automation + Audit-Ready Docs |

| Fees | 5–15% Broker Commissions | Flat 1% Transfer Fee + $1,000 Registration |

| Buyer Access | Limited Network, Slow Negotiations | Instant Access to Pre-Vetted Buyers |

| Team Bandwidth Required | 200+ Hours / Transaction | Minimal Lift—You Upload, We Handle the Rest |

Our team combines decades of expertise in tax credits, finance, and technology

Expert in Fintech, Data & AI Platforms | State Farm, Standard Chartered Bank

$30B+ in Structured Bonds & Finance | Citibank, Bank of America, Stanford

Expert in Tax Law, Compliance & Tax Strategies

Risk, Compliance, Blockchain & AI

Most clients save 40% of the time they'd typically spend on ITC compliance. For the average TPO, this translates to over 200 hours saved per transfer process.

We combine AI automation + 40+ years in tax credit expertise to maximize your savings and minimize risk. Our platform is specifically designed for solar TPOs with a focus on residential solar and battery storage projects.

Regardless of project size, our simple pricing structure helps you only pay a small fraction of what you earn:

Industry leading Flat $1,000 registration fee, 1% transfer fee on credits sold

After your initial strategy call, we can have you onboarded within 48 hours. Our intuitive platform requires minimal training, and our team provides personalized support throughout the process.

Stop leaving money on the table. Automate your entire ITC process today.

Book Your Demo →